Financial services businesses are already in the sights of cybercriminals, and understanding how cyber attacks impact this sector specifically can help establish the need for improved preventative measures.

Financial services businesses are already in the sights of cybercriminals, and understanding how cyber attacks impact this sector specifically can help establish the need for improved preventative measures.

At the end of last year, I highlighted how the finance and insurance sector experienced the most cybersecurity incidents in 2022, making them the most likely to be attacked. But new data from Barracuda’s new 2023 Email Security Trends report shows exactly how these more frequent attacks – when successful – impact the organization.

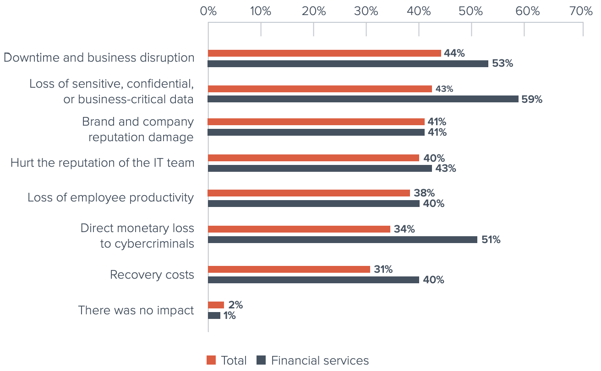

Only 1% of financial services businesses who experienced a successful email-based cyber attack saw no impact. So, basically, financial institutions need email security.

According to the report, the top three impacts (in order) are:

- Loss of sensitive, confidential or business-critical data

- Downtime and business disruption

- Direct monetary loss to cybercriminals

The complete list is shown below.

Source: Barracuda

What makes the impacts so critical is the fact that all but one impact was felt by a higher percentage of financial services businesses than the overall average across all industries. The top three impacts I previously mentioned were the most significant increases as well.

In short, if you’re in financial services, an attack is going to hurt.

The financial services industry is one of the largest causes of cyber incidents (in 43% of reported cases) with employees who don’t follow the organizations cybersecurity policies. It’s one of the reasons organizations need Security Awareness Training so badly – users need to be educated about what constitutes a malicious email and understand the importance of good cyber hygiene and the role they play in strengthening the organization’s cybersecurity stance.

I don’t see cybercriminals letting up on the financial services sector, so it’s time to look at the data and see that shoring up the weakest parts of your security defenses is an absolute must.

Here's how it works:

Here's how it works: