Seemingly repeating the previous year, the FTC’s latest report highlights that nearly 70,000 people reported being the victim of a romance scam last year.

Seemingly repeating the previous year, the FTC’s latest report highlights that nearly 70,000 people reported being the victim of a romance scam last year.

There’s a saying about some people being unlucky in love. In the case of the victims of romance scams, those folks are really unlucky! The crux of an effective scam – whether we’re talking via phishing, social engineering on the web, using social media, etc. – is to create some emotional buy-in from the victim and create a sense of urgency.

According to the latest report from the FTC’s Consumer Protection Division, romance scams were alive and well in 2022, and are apparently doing a great job at convincing unsuspecting victims out of their hard-earned money. According to the FTC, the median loss in a romance scam last year was $4,400.

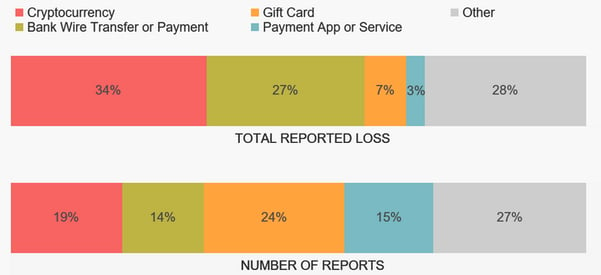

The top sites used to find and connect with victims were Facebook (in 28% of the scams) and Instagram (29%). The top payment methods were cryptocurrency (in 34% of scams) and bank wire transfers/payments (27%). Interestingly, while not the top payment method, gift cards took the spot as the most costly payment method.

Source: FTC

Source: FTC

This data demonstrates that if the right scam with the right execution hits just the right victim, both consumers and business employees alike are at risk of falling for scams. In the case of business (with the exception of the CEO gift card scam), it’s not the employee’s own money that’s of interest, it’s credentials and access that are the primary goal.

Regardless of whether we’re talking about protecting employees from a scam that impacts them personally, or a phishing attack that is intent on impacting the organization, putting them through new school Security Awareness Training is important so they can be educated on how these attacks and scams work, what to look for, and how to avoid becoming a victim.

The ModStore Preview includes:

The ModStore Preview includes: