Initial Access Brokers (IABs) are one of the new breeds of cybercrime services. But this newest PhaaS platform makes it easy for anyone to target banks for as little as $50 monthly.

Initial Access Brokers (IABs) are one of the new breeds of cybercrime services. But this newest PhaaS platform makes it easy for anyone to target banks for as little as $50 monthly.

In previous years, we’d see maybe an email with some bank’s logo embedded in it that took users to a pretty shoddy logon page that most anyone could see through (if they were paying attention!). But today’s cybercriminal is savvy and realizes the value of putting together an entire phishing kit that helps the cybercriminal from start to finish with a realistic-looking logon page. When you think about it, it just takes some time and effort to replicate any business’ logon page – if someone wants to spend enough time on it.

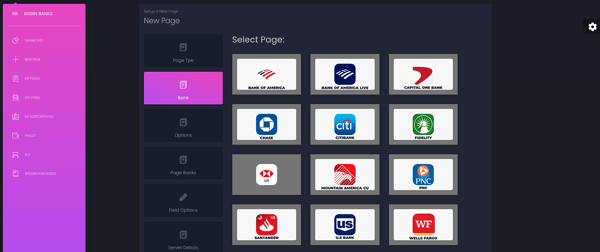

Security researchers at IronNet have identified a new IAB – “Robin Banks” (get it?) that primarily focuses on helping their “customers” build out pages that impersonate just about every major bank in the U.S., U.K., Canada, and Australia.

Source: IronNet

The platform even goes as far to detect bot traffic from security solutions and put up a reCAPTCHA page to evade detection.

For anywhere from $50-300 a month, cybercriminals can have a pretty decent spoofed website that looks like the real thing. The uptick in SMishing scams that use texts to connect with victims is a likely avenue to get users to engage with a message indicating anything from an account balance being low to a (false) credit card charge being approved, etc.

New school Security Awareness Training teaches corporate users to be constantly vigilant against any kind of unexpected message – whether sent via email, text, voice mail, etc. By educating them on how scams work, it becomes much easier for users to avoid becoming a victim, and spot a scam the moment it shows up in their Inbox or on their mobile phone.

Here's how it works:

Here's how it works: