This lucrative business of tricking companies into fraudulently transferring funds into cybercriminal-owned bank accounts is showing signs of growing. Scammers use many forms of attack to attempt to separate your organization from its’ money. BEC—aka CEO Fraud— is one of the easiest; using little more than really good social engineering in some cases, the bad guys have found that users can be easily fooled into sending the company’s money to a bad guy-controlled account.

This lucrative business of tricking companies into fraudulently transferring funds into cybercriminal-owned bank accounts is showing signs of growing. Scammers use many forms of attack to attempt to separate your organization from its’ money. BEC—aka CEO Fraud— is one of the easiest; using little more than really good social engineering in some cases, the bad guys have found that users can be easily fooled into sending the company’s money to a bad guy-controlled account.

Just last month, a group responsible for stealing nearly $12 million from 12 companies via BEC scams was arrested in Spain. With only about $1.4 million recovered, these scams are proving to be both lucrative to the attacker, and painful to the victim.

The high success rate of BEC attacks is due to the attacker’s ability to pretend to be someone trusted within the company (usually the CEO or the like), and leverage that established “credibility” to get employees to do their bidding – usually to the tune of making a “payment” of some kind to a partner, vendor, etc.

The mammoth estimated losses of $26 billion from June 2016 through July 2019 demonstrate that organizations need to a) recognize this as a real risk and b) understand they need to prepare their employees against such attacks.

The most effective way to protect against BEC attacks is the recipient user. By educating them on how these scams work and how to spot one quickly through Security Awareness Training, organizations can elevate the organization’s preparedness against such attack well-before an attack attempt ever takes place.

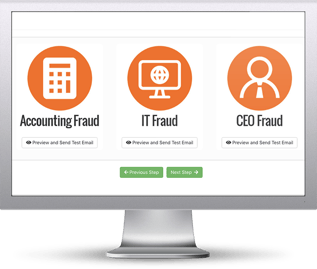

Here's how it works:

Here's how it works: