Industry analysts Piper Sandler do a yearly 'Industry Note' where they survey CIOs about their next year budget expectations. For 2024 there is a noticeable improvement regarding enterprise IT spending.

Industry analysts Piper Sandler do a yearly 'Industry Note' where they survey CIOs about their next year budget expectations. For 2024 there is a noticeable improvement regarding enterprise IT spending.

The header of their survey was: "2024 CIO Survey | Investments in Security, AI, and Cloud Driving IT Rebound". Here is the summary of the full report which is a good read and warmly recommended.

Their conclusion: "We saw a noticeable improvement in enterprise IT spending optimism ahead of 2024, 2025, and 2026 with expectations of a slight acceleration of 60-70 basis points in each of the next three years with IT budget growth reaching 5.1% by 2026 from 3.1% in 2023 and materially higher than 1.6% in 2022.

Cloud spending intentions were even stronger, accelerating to 8.9% in 2024, 10.5% in 2025, and 12.1% in 2026 (compared to 6% in 2023 and 1.4% in 2022). After two years of digestion from the pandemic growth peak during 2021, it appears the enterprise appetite to invest in strategic areas like security, cloud, and AI could help drive a broader spending recovery across the enterprise IT stack.

- Budget optimism growing after two years of digestion. Guardrails on IT spending two years removed from the pandemic peak in 2021 appear to be coming off based on increasing budget optimism, in part driven by a spending reprioritization around strategic investments in security, cloud, and AI.

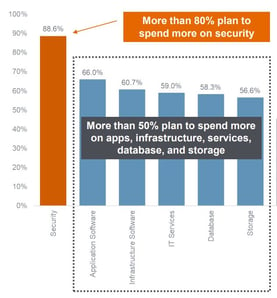

- Security priority surges with 89% planning to spend more. Top spending priorities by category showed six areas where more than 55% plan to spend more in 2024 including 1 - Security (88.6%), 2 - Applications (66%), 3 - Infrastructure (60.7%), 4 - IT Services (59%), 5 - Database (58.3%), and 6 - Storage (56.6%).

- Enterprise AI spending intentions doubled from last year. The breadth of enterprise interest in AI continues to surprise us with 73% planning, testing, or implementing Gen AI in 2024. 49% named Microsoft as most strategic while OpenAI was the next most strategic at 17%. 51% plan to implement M365 Copilot with plans to deploy across 34% of employee base (surprisingly high).

- Cloud budget growth may double to 12% on “AI Halo Effect”. Cloud industry growth (n=100) peaked in 2021 during the pandemic bubble at a 34% median but has slowed for two years to a 15% median in 4Q23E. 2024 could be the beginning of the next cloud investment cycle, in part driven by an ‘AI Halo Effect’ where an increasing volume of data pivots to the public cloud and edge cloud.

- Database, IT services, and Comm SW intentions rose the most y/y. Spending intentions improved across all product categories from the July 2023 survey with the highest improvement on a y/y basis across three areas: 1 - Database, 2- IT Services, and 3 - Comm SW.

To get access to the full report, contact your Piper Sandler Representative. You can find them here. In the meantime, get a demo of the KnowBe4 platform, even if you already had one. There are a number of powerful new features you have not seen yet.

Security Awareness Training is critical to enabling you and your IT staff to connect with users and help them make the right security decisions all of the time. This isn't one and done. Continuous training and simulated phishing are both needed to mobilize users as your last line of defense. Request your one-on-one demo of KnowBe4's security awareness training and simulated phishing platform and see how easy it can be!

Security Awareness Training is critical to enabling you and your IT staff to connect with users and help them make the right security decisions all of the time. This isn't one and done. Continuous training and simulated phishing are both needed to mobilize users as your last line of defense. Request your one-on-one demo of KnowBe4's security awareness training and simulated phishing platform and see how easy it can be!